Introduction

The relationship between financial institutions and payment platforms has always been dynamic, shaped by consumer needs, technological innovation, and evolving corporate strategies. Among the most widely recognized collaborations has been between American Express (Amex) and PayPal. For years, many customers have used PayPal’s Bill Pay service to conveniently handle recurring expenses with their American Express cards. This setup allowed users to streamline payments, consolidate accounts, and enjoy the flexibility of paying bills with their Amex card through PayPal’s secure network.

However, recent announcements have surfaced regarding Amex PayPal Bill Pay payments ending, leaving many cardholders confused, concerned, and looking for alternatives. Understanding what this change means, why it happened, and how it may affect your financial management is crucial for anyone who has relied on this service.

This article will provide a complete breakdown of the Amex PayPal Bill Pay payments ending, covering its background, the implications for Amex cardholders, possible reasons behind the decision, and most importantly, the alternatives and strategies to navigate this shift.

Background: How Amex and PayPal Bill Pay Worked

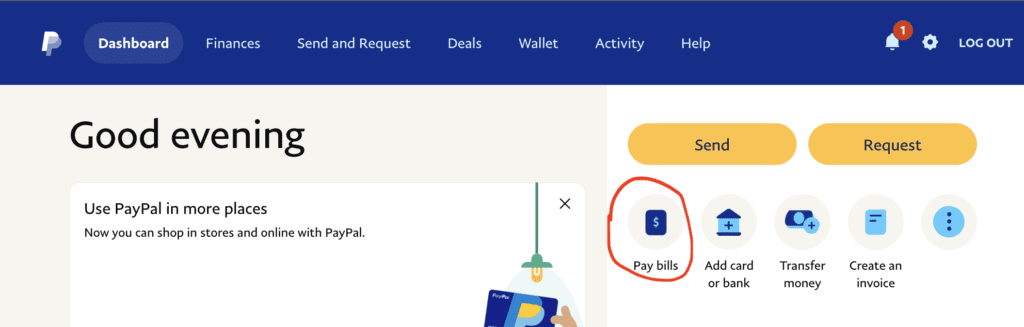

To understand the impact of the Amex PayPal Bill Pay payments ending, it is helpful to revisit how the partnership functioned. PayPal, over the years, has offered a Bill Pay feature that allowed users to schedule and manage payments directly from their PayPal accounts. Customers could link debit cards, bank accounts, and credit cards—including American Express cards—to fund these bill payments.

For many Amex users, this was especially attractive for several reasons:

- Rewards and Benefits: By funding payments through an Amex credit card, customers could still earn Membership Rewards points, cash back, or travel rewards even on routine bills.

- Convenience: Instead of paying each bill separately, PayPal’s Bill Pay created a central hub for all expenses.

- Security: PayPal acted as a buffer, minimizing the need to share sensitive card details directly with multiple merchants.

- Flexibility: Some users leveraged Amex features like “Pay Over Time” alongside PayPal’s scheduling capabilities, adding layers of financial management.

This setup became a standard habit for many households and businesses, which is why the news of Amex PayPal Bill Pay payments ending has created a ripple of concern.

The Announcement: Amex PayPal Bill Pay Payments Ending

The confirmation that Amex PayPal Bill Pay payments are ending came as part of updates to terms of service and customer communications. PayPal notified users that American Express credit cards would no longer be supported for their Bill Pay service.

While not every detail of the corporate reasoning has been disclosed publicly, the decision appears to be mutual or at least accepted by both parties. The wording suggests a strategic change rather than a temporary technical issue.

The effective date varies depending on when users received the communication, but the core message remains: Amex PayPal Bill Pay payments ending means that users can no longer use American Express cards to fund their scheduled or one-time bill payments through PayPal.

Why Is This Happening? Possible Reasons

When analyzing the decision of Amex PayPal Bill Pay payments ending, several plausible factors emerge.

1. Transaction Fees and Cost Structure

American Express is known for having higher interchange fees compared to other card networks like Visa or Mastercard. For platforms like PayPal, which already deal with tight margins on bill pay services, continuing to support Amex may have become financially unsustainable.

2. Strategic Shifts

Both Amex and PayPal are large organizations with evolving strategies. PayPal has increasingly focused on peer-to-peer transfers, merchant solutions, and buy-now-pay-later (BNPL) products, while Amex has doubled down on premium cardholders, travel partnerships, and direct integrations. Supporting each other’s services may no longer align with their broader roadmaps.

3. Regulatory and Risk Considerations

Bill Pay inherently involves recurring transactions, sometimes large in value. Risk management concerns, compliance requirements, and dispute-handling costs could have made the Amex-PayPal pairing more complicated than other options.

4. Push for Direct Ecosystem Use

Both companies may prefer that users engage directly within their ecosystems. For example, Amex would rather customers use Amex’s own bill pay tools or payment portals, while PayPal may want customers to rely on linked bank accounts instead of credit cards for recurring payments.

How Does Amex PayPal Bill Pay Payments Ending Affect Customers?

For consumers, the Amex PayPal Bill Pay payments ending announcement translates into several practical implications.

1. Loss of Rewards on Bill Payments

Amex cardholders who strategically used PayPal to earn rewards points or cash back on recurring bills will lose that avenue. Bills like utilities, rent, or tuition that were previously routed through PayPal to earn rewards will now need direct handling.

2. Reduced Convenience

Instead of having one hub (PayPal) to manage multiple bills, users will need to set up direct payments with each biller or find another aggregator.

3. Impact on Budgeting Habits

Some users relied on PayPal’s dashboard for budgeting and tracking expenses. With Amex no longer part of the system, they must adapt their financial management approach.

4. Possible Payment Disruptions

Users who had automatic payments set up may face disruptions if they don’t update their billing information promptly. Missed payments could lead to late fees or service interruptions.

Alternatives After Amex PayPal Bill Pay Payments Ending

With Amex PayPal Bill Pay payments ending, customers naturally want to know what their alternatives are. Thankfully, several options exist:

1. Amex Bill Pay Services

American Express itself offers bill pay functionality, allowing cardholders to schedule payments directly from their accounts. While it may not offer the same level of consolidation as PayPal, it keeps the Amex ecosystem intact.

2. Bank Bill Pay Platforms

Most major banks and credit unions provide free bill pay services within online banking platforms. Users can link their Amex cards indirectly by routing payments through their checking accounts, though this won’t always earn credit card rewards.

3. Third-Party Payment Apps

Other platforms like Plastiq (though often with fees) allow users to pay bills with credit cards, including Amex. These services may replace some of the lost functionality, though at an additional cost.

4. Direct Biller Payments

In many cases, billers themselves accept Amex cards directly. Setting up autopay directly with the utility, service provider, or institution may actually be simpler than routing through PayPal.

5. Budgeting Apps with Payment Features

Some financial technology apps integrate both expense tracking and bill pay, offering a modern alternative to PayPal’s Bill Pay. Checking whether they accept Amex is crucial before switching.

Strategies to Adapt to Amex PayPal Bill Pay Payments Ending

When faced with Amex PayPal Bill Pay payments ending, adopting strategies to minimize disruption is important.

- Audit Your Current PayPal Bill Pay Setup

- List all the bills that were linked with Amex through PayPal.

- Identify which ones accept Amex directly and which don’t.

- List all the bills that were linked with Amex through PayPal.

- Update Payment Information Promptly

- Switch your payment method before the service ends to avoid missed payments.

- Switch your payment method before the service ends to avoid missed payments.

- Explore Reward Alternatives

- If your goal was earning rewards, consider routing bills through other platforms that still accept Amex.

- If your goal was earning rewards, consider routing bills through other platforms that still accept Amex.

- Leverage Amex Offers and Promotions

- Amex frequently provides targeted offers for utilities, subscriptions, and services. These may partially offset the loss of PayPal rewards.

- Amex frequently provides targeted offers for utilities, subscriptions, and services. These may partially offset the loss of PayPal rewards.

- Stay Informed

- Corporate strategies evolve. Keeping track of Amex and PayPal updates may reveal future integrations or new features.

- Corporate strategies evolve. Keeping track of Amex and PayPal updates may reveal future integrations or new features.

The Broader Significance of Amex PayPal Bill Pay Payments Ending

The Amex PayPal Bill Pay payments ending is not just about one feature disappearing. It signals broader trends in the financial services industry:

- Consolidation of Ecosystems: Companies are increasingly creating closed ecosystems, discouraging cross-platform functionality.

- Changing Economics of Payments: With shifting interchange fee structures and evolving regulations, companies are reassessing partnerships.

- Rise of Fintech Alternatives: Independent fintechs are stepping in where traditional players pull back.

- Customer Adaptability: Consumers are becoming accustomed to constantly evolving financial tools and must remain flexible.

Looking Ahead: Will Amex and PayPal Collaborate Again?

While the current chapter marks Amex PayPal Bill Pay payments ending, it does not necessarily mean the end of all collaborations between these two giants. Both companies continue to have overlapping user bases, and customer demand may eventually push them toward creating new partnerships in different areas, such as merchant payments, digital wallets, or loyalty integrations.

However, for the foreseeable future, customers should operate under the assumption that Amex will not be an option for PayPal Bill Pay. Preparing alternatives now is the safest strategy.

Conclusion

The announcement of Amex PayPal Bill Pay payments ending is a significant change for many American Express users who relied on PayPal’s Bill Pay service. It removes a convenient tool for consolidating bill management, disrupts reward-earning strategies, and requires users to adjust their financial habits.

While the reasons may include high transaction fees, strategic realignment, and risk management, the impact is clear: customers must seek new solutions. Thankfully, alternatives exist, ranging from Amex’s own bill pay options to bank platforms, third-party apps, and direct biller integrations.

The broader financial landscape will continue evolving, and adaptability will be key for consumers. By staying informed and proactive, Amex users can smoothly transition despite Amex PayPal Bill Pay payments ending, ensuring continued convenience, security, and reward optimization in their financial management.