Introduction

The fintech industry has gained remarkable momentum, providing invaluable solutions for startups and entrepreneurs. With an ever-growing need for seamless payment processing, platforms like MoneyPoolsCash.com have emerged to serve high-risk ventures that traditional fintech companies often overlook. In this article, we will delve into the features and advantages that set MoneyPoolsCash.com apart and explore how it holds up against notable competitors in the fintech landscape.

Competitors Analysis

- PayPal – PayPal is a household name when it comes to digital payments and e-commerce solutions. However, their fee structure can deter smaller businesses, especially those operating in high-risk industries. PayPal charges transaction fees that can eat into profits, particularly for startups. Moreover, their chargeback policy is stringent, which exposes businesses to unexpected costs.

- Square – Square has gained popularity for its user-friendly point-of-sale (POS) solutions. While it is beneficial for many small businesses, it doesn’t provide specialized services for high-risk clients. Businesses categorized as high-risk often face delayed payments or additional scrutiny, leading to cash flow issues.

- Stripe – Stripe is renowned for its robust API that supports various currencies and international payments. However, it can be challenging for high-risk ventures to set up accounts due to strict verification processes. Moreover, the emphasis on technology may limit its customer service offerings.

- Chime – Chime serves as a neobank aimed primarily at consumers. While it is attractive due to its lack of fees, Chime lacks offerings tailored to businesses, particularly in high-risk sectors. Entrepreneurs often find themselves needing additional services that Chime does not provide.

- Authorize.Net – Authorize.Net was one of the pioneers in online payment processing. While it serves many established businesses well, its complicated fee structure can be daunting for startups. High-risk businesses may discover that Authorize.Net lacks flexibility in its offerings, leading them to look for alternatives.

- WePay – WePay focuses on integrated payment processing, especially for platforms that host payment systems. Nonetheless, its risk management measures can be rigorous, making it difficult for high-risk ventures to establish accounts. This limitation leads to unnecessary hurdles for entrepreneurs who need quick access to funds.

Analysis of MoneyPoolsCash.com

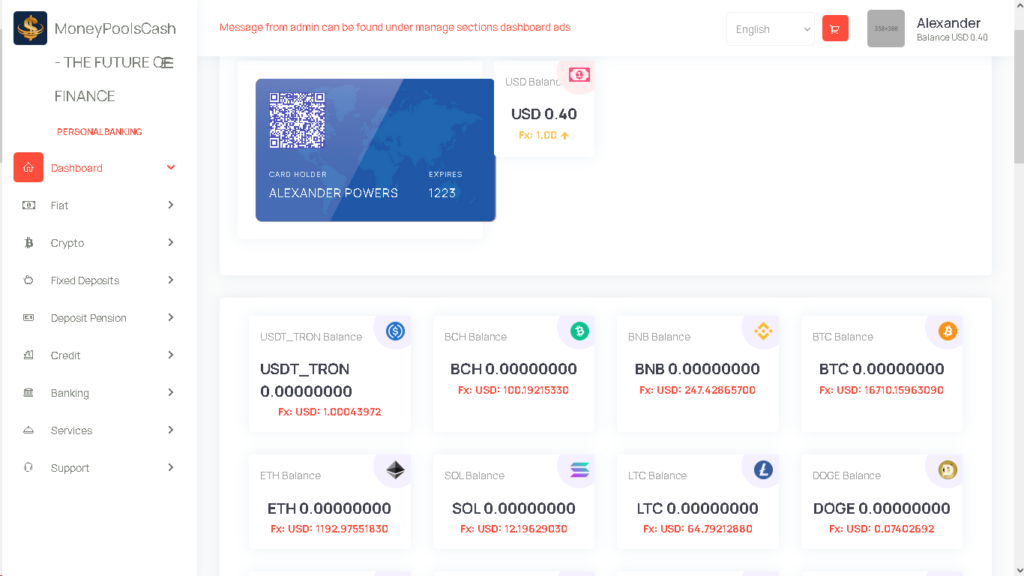

In contrast to these competitors, MoneyPoolsCash.com emphasizes transparency and support for high-risk ventures. The platform offers instantaneous payments, eliminating the traditional barriers associated with chargebacks. As part of its holistic approach, MoneyPoolsCash.com focuses on providing an uncomplicated user experience through an easy onboarding process tailored specifically for high-risk entrepreneurs. As a result, startup founders can access cash flow when they need it most without having to navigate cumbersome processes.

Furthermore, MoneyPoolsCash.com recognizes the importance of tech integration. The platform is adaptable, allowing businesses to integrate directly with their existing economic systems, providing a seamless transition for new users. Its focus on technology and financial empowerment places MoneyPoolsCash.com at the forefront of fintech.

Conclusion

MoneyPoolsCash.com stands out in the crowded fintech landscape by prioritizing high-risk ventures and offering tailor-made solutions that outpace traditional platforms. Entrepreneurs can experience immediate funding access without the burden of overhead fees.

Call to Action

To learn more about how MoneyPoolsCash.com can elevate your business and provide an atmosphere of support for high-risk entrepreneurs, visit MoneyPoolsCash.com.